Self-employed options

- Published: Feb 24, 2014 00:26

- Writer: Post Reporters | 4,293 viewed

The deadline for filing 2013 personal income tax returns is fast approaching. Under the "self-assessment system", individuals are required to file their tax returns by March 31.

There is no limit on the amount of itemised deductions, but if you choose to itemise, you must be able to provide supporting evidence.

Taxpayers with earned income from employment can only claim expenses as tax deductions using the standard deduction method, with a maximum amount of 40% of gross assessable income but not exceeding 60,000 baht.

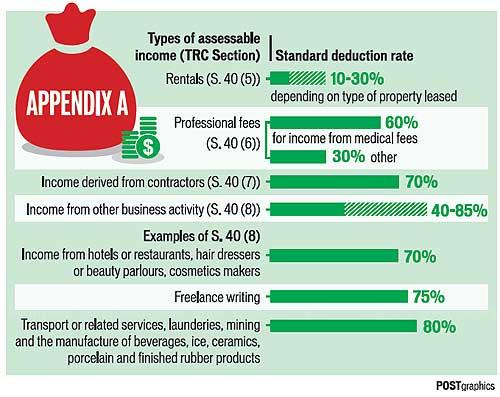

Meanwhile, taxpayers with earned income from self-employment, with some exceptions for certain types of income, may choose between itemising the expenses incurred during the tax year or taking the standard deduction, which ranges from 30% to 85% depending on the type of assessable income.

Of course, your tax burden will be smaller if your itemised deductions are greater than your standard deduction. There is no limit on the amount of itemised deductions, but you should be aware that for self-employed taxpayers, the rules and conditions for the computation of net taxable profits for corporate income tax purposes shall apply in determining the deductible expenses. That is, if you choose to itemise, you must be able to provide supporting evidence to show that the itemised deductions are in accordance with Section 65 bis and 65 ter of the Thai Revenue Code (TRC).

Section 65 bis of the TRC provides the conditions for the computation of net taxable profits, such as the methods for calculation of depreciation and inventory. Section 65 ter of the TRC provides the items for which a deduction is not allowable by a company when computing its net taxable profit.

It is important to note that after you have filed your tax return for the year, you cannot later change your choice of expense deduction method.

In the event of a tax audit, the tax authorities will require you to furnish evidence to support the expense deductions. If the tax authorities do not allow certain expense deductions and it causes the itemised deduction total to be less than the standard deduction total, you cannot change back to the standard deduction method and you will be assessed the additional tax plus a 1.5%-a-month surcharge on the amount of tax due and maybe a penalty of up to the amount of tax due.

In this regard, if you have self-employment income for which you are considering using itemised expense deductions, you must ensure that you do not claim expenses that are specifically disallowed under Section 65 ter of the TRC for corporate income tax purposes. The disallowed items include "expense that was not actually incurred" and "expense for which a payer cannot identify the recipient".

Thus you should only claim expenses for which supporting evidence of actual payment in the form of tax receipts is available and maintained. In addition, you must be able to prove that the expenses you deducted were for business purposes.

You may be required to satisfy the tax authorities that the expenses you claimed as deductions were directly related to the business where you earn your self-employment income. Proper records should be prepared, along with maintenance of supporting documents.

In applying the provisions of the TRC's corporate income tax to personal income tax computation, some provisions may be non-applicable or create uncertain positions.

One of these uncertain positions concerns the net loss incurred from the business. For corporate income tax purposes, annual net loss after tax adjustments can be carried forward for five accounting periods under Section 65 bis (12) of the TRC.

There is no clear standard for whether the net loss from business can be carried forward for personal income tax purposes. As a loss is generally not allowed to be deducted for personal income tax purposes (such as losses from stocks or assets sold), the tax authorities may not allow the deduction of the loss from business.

Once you choose to use itemised expense deductions to compute the tax on your self-employment income, the choice remains in effect for that year but not for future years. Your choice is on a yearly basis with no prior approval required. The choice of claiming either itemised deductions or the standard deduction is made on your filed tax return.

Before filing your tax return, you should review the expenses and consider whether the total of itemised expenses is larger than the standard deduction would be. If not, it may be better to claim the standard deduction, which is not likely to be challenged by the tax authorities and would not put you at risk for an additional tax assessment.

To take the standard deduction, you must ensure that you have classified your self-employment income correctly: the rate for the standard deduction varies depending on the type of assessable income. See Appendix A for types of assessable incomes and their corresponding standard deductions, which are optional; the taxpayer may elect to itemise deductions. You can find more details in Royal Decree No.11 of 1959.

How is investment income taxed? Investment income is generally taxed in the same way as ordinary income and is subject to the same tax rate as other forms of earned income. Investment income for these purposes includes interest, dividends, capital gains, royalties and income from real estate. Taxpayers who earn high income and fall into high tax brackets will probably pay tax on investment income at the highest tax rate.